The Heretic Master Data Management Question: Trade Speed for Data Quality

In my last whitepaper The e-Syndication MDM Architecture Pattern, I had mentioned that as companies are beginning to exploit their Master Data Management (MDM) systems to increase online sales by syndicating their product Master Data to online eCommerce channels like Amazon, Walmart, eBay and Kroger, they will potentially need to trade some data quality for speed. At first sight, by suggesting that there exist situations where it is perfectly valid to trade data quality for faster go-to-market of a product, it looks like I am committing MDM heresy.

After all, doesn’t MDM exist to improve the data quality of Master Data across an enterprise?

The real meaning

Firstly, note that when I say data quality, I really mean data richness and not data accuracy. In MDM parlance the definition of data quality encompasses not just the accuracy of data but also the richness of the attributes that describe an entity (like a product). One of the primary goals of the enrichment of product attributes is to position that product for marketing. So, when I claim some data quality will be compromised, I am referring to the enrichment of information and not accuracy. Secondly, when I refer to speed, I am talking about the speed at which new products are introduced to the market (online markets in this case).

The online sales acceleration

If you have read the article on the eSyndication MDM pattern, you will observe that even traditional B-B companies are looking at B-C channels to sell their product directly to the consumer. This pivoting of sales strategy which started in recent years is accelerating at a frantic pace now due to the Covid-19 induced economic crisis. Traditional B-B sales channels and supply chains have been disrupted forcing companies to seek direct to consumer sales and established online markets like Amazon offer the perfect solution to meet this goal.

The justification

However, there is a problem. Selling online right now happens to involve a “throw the kitchen sink” approach where merchants are looking to sell via multiple online markets as they are not certain which of these channels will offer an acceptable return on investment. Selling via a single or very limited marketplace is risky, so sellers are taking the approach of selling on as many marketplaces as possible and see which one’s stick. Though this kitchen sink approach could be prudent considering the need to hustle quickly and recover lost revenue, it does throw up the challenge of preparing the data to be sold into all these different marketplaces. In addition, as I mention in the eSyndication MDM pattern article, there are additional challenges to be navigated in terms of establishing the connections, adherence to schemas and such.

Imagine a merchant decides to sell through ten online markets. It is potentially a daunting and time-consuming task to prepare and enrich the data for all these ten different channels especially when the product catalog is fairly large. If the merchant is in the business of selling fast-changing product catalog like say apparel, the product go-to-market needs to be even faster which makes the task of data syndication to multiple channels exponentially tougher. Apparel is a prime example of the need to trade speed for extensive data enrichment. On the flip side, if the seller is in the business of selling vacuum cleaners or electric shavers where only a handful of new products are released or updated per year, they have the flexibility of spending a lot more time enriching data without having to worry about fast introduction of products.

A couple of examples

First example: a fast-moving product

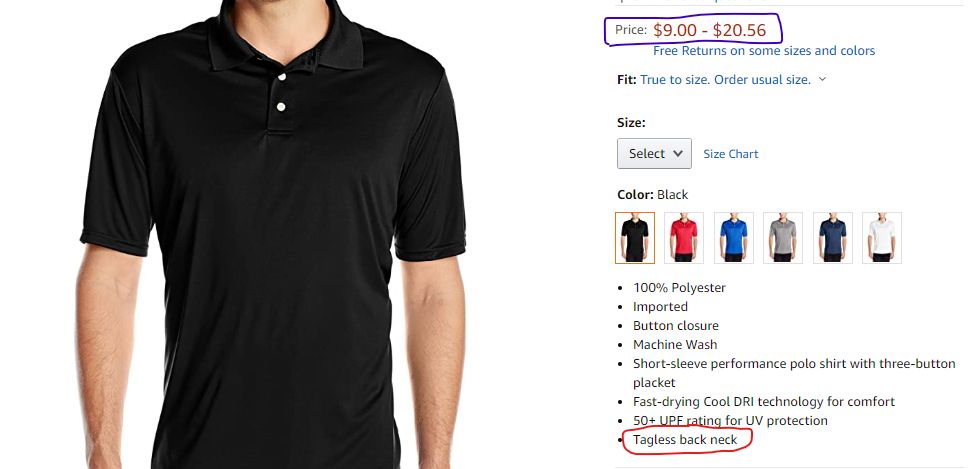

Look at these examples below that were taken from Amazon. First, is an apparel example to illustrate a product catalog that comes in large volumes, has many variations (different styles, colors and sizes). It is also a category with a high turnover (and price updates) since it is directly related to people’s choice of style and fashion. Thus, apparel is a category that replaces products frequently, so it needs new products to be introduced faster. In this case, if the merchant in the haste to sell their polo shirts on multiple online channels quickly, forgets or ignores to specify that the polo shirt has a tagless back neck (circled in red in the picture), it will cause little if any impact to sales. However, they will be well-served not to trade speed for accuracy. For example, they need to get the pricing attributes to be accurate (circled in blue).

Second example: a slow-moving product

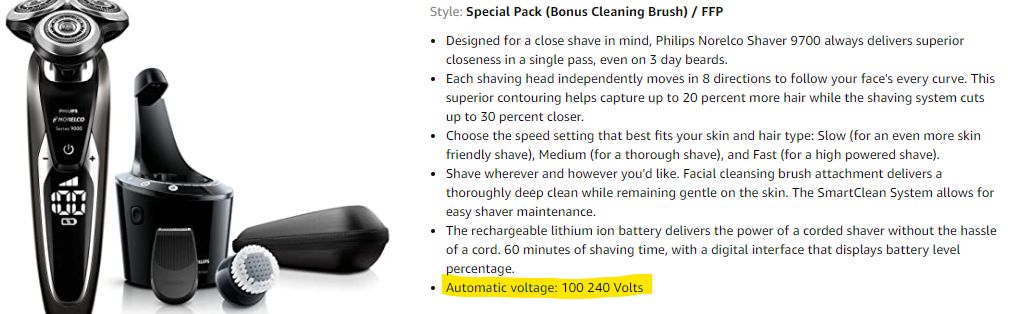

Now let us consider an example of a product category like the men’s electric shaver. This an example of a product that once it is introduced tends to stay in the online catalog for a while. New models of the product are not introduced very frequently and even when they are the older models tend to continue to be sold online until they are gradually retired. Thus, products like the shaver have a slower rate of new product introduction and as a consequence afford the seller a lot more time to work on the product data enrichment. Also, since it’s a category that is not necessarily dependent on fashion, the variation in terms of data attributes by channel (that is the need to customize the data for the channel it’s being sold on) is negligible. Even when the merchant is selling the product on multiple channels, the need to rush the product data syndication is unnecessary. In fact, the richer the data, the better its marketability.

To illustrate, in the picture notice the importance of even a seemingly innocuous piece of information like the supported voltage. Forgetting to include this in the product description could potentially result in international travellers who make up a decent proportion of buyers of shavers to walk away.

Conclusion

Contrary to the core principals of Master Data Management, there are certain situations where data quality pertaining to the richness of product attributes can be somewhat lowered in favor of accelerated product introduction especially when selling the product on multiple marketplaces. In such cases, where slow go-to-market negatively impacts sales, slowing the introduction of the product by holding it in the MDM workflow in order to keep enriching the content could be counterproductive.